Although the Tax Cuts and Jobs Act’s (TJCA) changes to meals and entertainment expenses went into effect for expenses incurred or paid after December 31, 2017, the deductibility of meals and entertainment expenses remains a hot (and confusing) topic among business owners today.

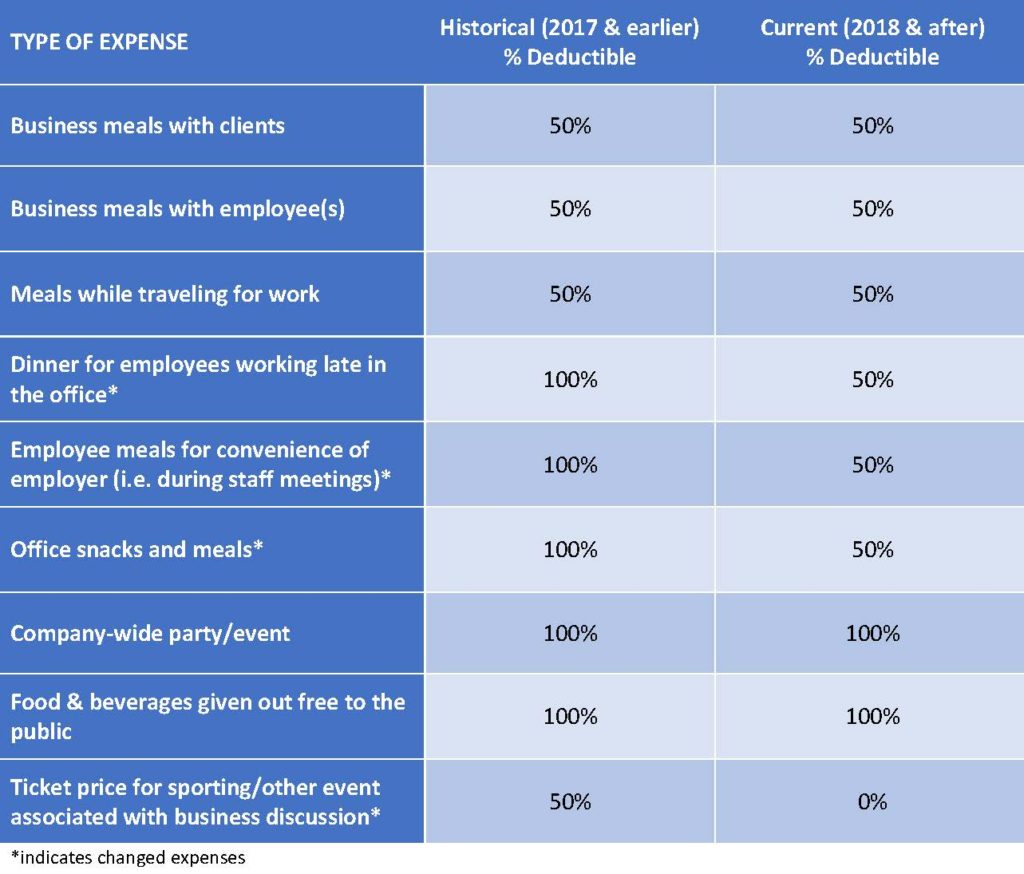

The following chart summarizes the results of the TJCA and its effect on meals and entertainment expenses. Due to the various levels of deductibility, we recommend you make changes to your chart of accounts to separate out meals and entertainment and two separate expense items as well as a separate 100% deductible meals expense account if relevant to your company’s business expenses.

Please contact your dedicated accountants at Stephano Slack LLC at 610-687-1600 for additional questions and discussion.

Recent Comments